Borrowers must get 21-day notice before fraud tag: RBI

[ad_1]

RBI has asked banks to put in place a board-approved policy on fraud risk management which specifies the responsibilities of the board. “The policy should also incorporate measures for ensuring compliance with principles of natural justice in a time-bound manner,” RBI said. It said banks should form a committee on frauds, comprising at least three board members including a full-time director and at least two independent or non-executive directors. The committee should be chaired by one of the independent or non-executive directors.

RBI has asked banks to review the Supreme Court’s and various high court orders which emphasize the need of notifying individuals or entities, providing them with an opportunity to respond, before classifying them as fraud and issuing a reasoned order.

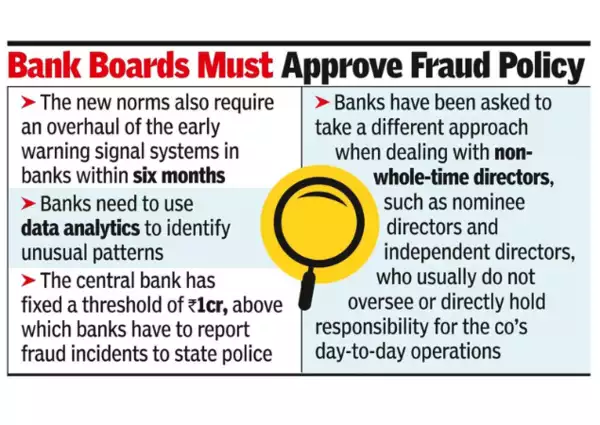

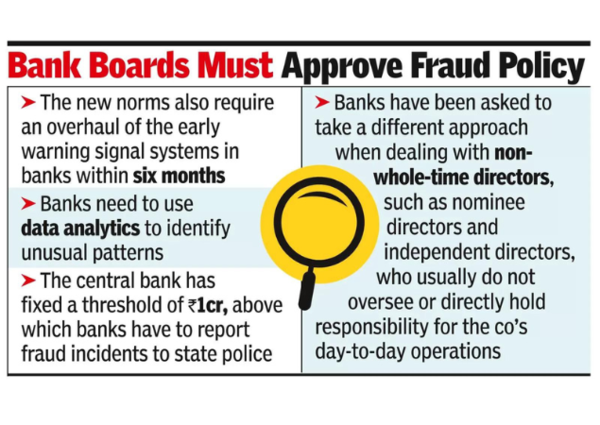

The new norms also require an overhaul of the early warning signal (EWS) systems in banks within six months. The EWS has to be integrated with systems and need to use data analytics to identify unusual patterns besides parametric indicators.

The central bank has fixed a threshold of Rs 1 crore above which banks have to report fraud incidents to state police. Private banks have to report frauds above Rs 1 crore to the Serious Fraud Investigation Office and the ministry of corporate affairs. For public sector banks, the Rs 6 crore threshold for reporting frauds to the CBI continues.

Banks have been asked to take a different approach when dealing with non-whole-time directors, such as nominee directors and independent directors, who usually do not oversee or directly hold responsibility for the company’s day-to-day operations.

“In case of consortium lending, each of the consortium member may file separate complaints, if separate offences have been committed in respect of each of them and if the fraud so committed is not part of the sa0me fraudulent act / transaction. In other cases of such lending, only one member may file a complaint and all the other members may extend necessary support,” RBI said.