Economy may grow 6.5%-7% as momentum is strong: CEA

[ad_1]

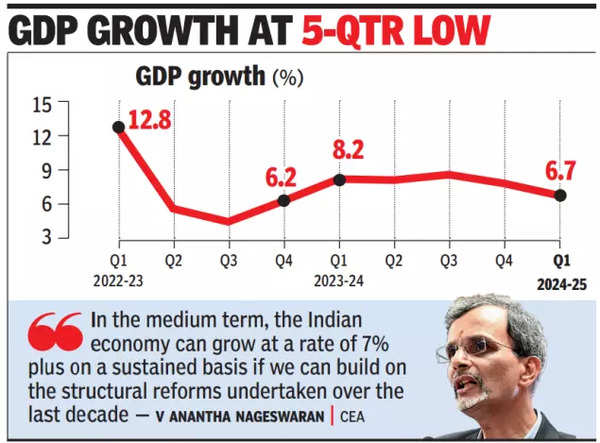

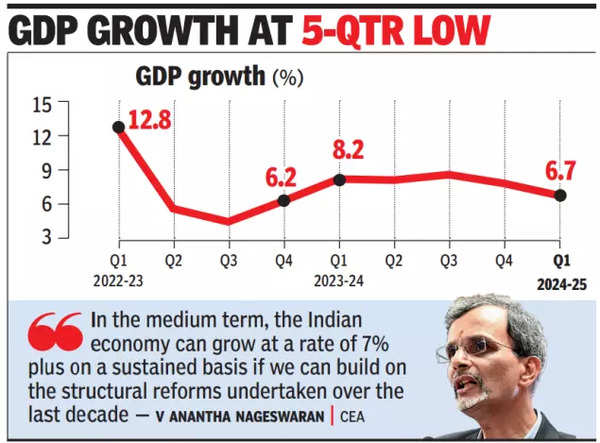

“In the medium term, the Indian economy can grow at a rate of 7% plus on a sustained basis if we can build on the structural reforms undertaken over the last decade,” the top economist in the finance ministry said in a presentation after the first quarter GDP numbers were released.India remains the fastest growing major economy despite the pace of growth slowing to a five-quarter low of 6.7% during April-June.

Describing the numbers on expected lines in the wake of intense summer and elections, Nageswaran was upbeat on the growth projections, arguing that private investment was rising, which was reflected in the overall capital formation data.

Besides, he was upbeat on the farm sector and rural demand, which has grown consistently for five quarters. “Although agriculture growth in real terms was 2% in the first quarter, going forward, given the fact that there are very few deficit monsoon divisions, sowing of pulses and cereals is higher and the reservoir storage is higher than last year and 10-year average, agriculture will see a rebound in growth as we head further into the financial year.”

He also drew comfort from “very steady expansionary phase” in manufacturing and an upbeat services sector.

Nageswaran pointed to strong demand for passenger vehicles, airlines as well as two-wheelers and tractors to argue that urban and rural consumption was steady. The govt economist further argued that the fear of food inflation spilling into other segments was not borne out by data and inflation expectations remained below last year’s level.

At the same time, he warned of possible risks including electoral outcomes in several countries impacting global trade and investment. “Escalation of geopolitical conflicts may lead to supply dislocations, higher commodity prices, reviving inflationary pressures and stalling monetary policy easing with potential repercussions for capital flows,” he added.

Potential corrections in financial markets too could impact household finances and corporate valuations.