Global QSR brands lose mojo in India

[ad_1]

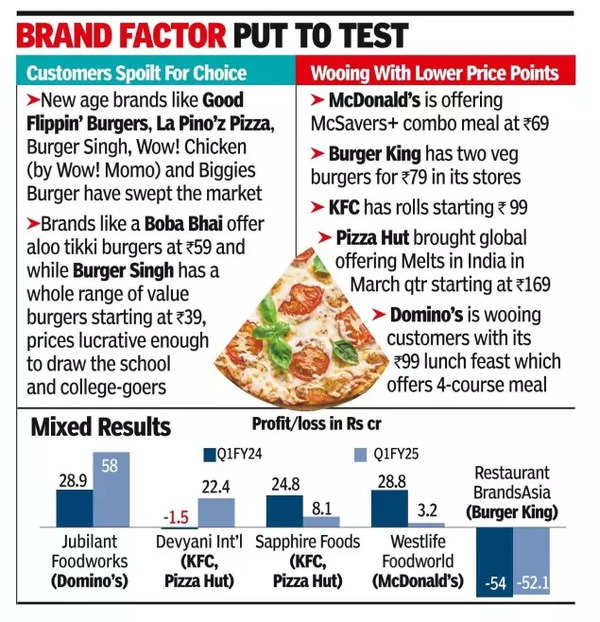

Be it the rise of new age food brands that are finding favour with venture capital (VC) investors who are backing them with funds to scale up or the growth of Zomato and Swiggy which offer consumers access to a variety of food brands at the tap of their smartphones, global QSR giants have been struggling to get customers to their stores.

Westlife Foodworld, which operates McDonald’s chain of outlets in West and South India, said at the company’s Q1 earnings call: “….there’s obviously been pressure in terms of customers entering our restaurants”.

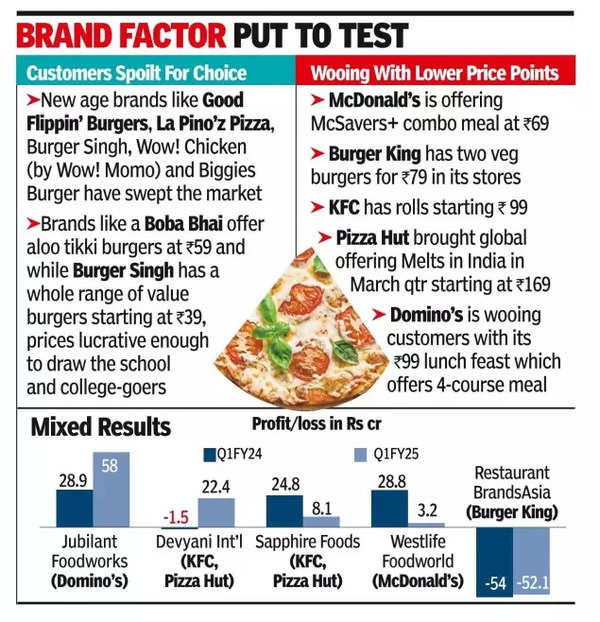

The company launched McSavers+ in Q1 which allows customers to get a chicken burger or a snacking item of their choice (from among a range of options available) and a Coke combo meal at Rs 69. Burger King is offering consumers two veg burgers for Rs 79 and two non-veg burgers for Rs 99. KFC and Pizza Hut are also in the ‘value’ queue, with meal options at Rs 99, Rs 149 and Rs 169. Domino’s is wooing customers with its Rs 99 lunch feast.

“Pizza Hut has been working on product and value strategies that work towards making the brand relevant for a cross-section of consumers, especially Gen Z,” said a local company spokesperson.

Ravindra Yadav, partner at Technopak, said such offerings are “desperate measures” to get customers back. “It’s a flawed long-term strategy. If they focus on value, they will be impacting their profitability or compromising on the quality of the product,” said Yadav. Global brands have always been aspirational for local consumers and on many counts, they perhaps still are but in a market where young, experimental Gen Z and millennial consumers are dictating consumption patterns, companies need to have more than just a brand pull. They are not innovating enough, said analysts.

“The consumer today is spoilt for choice and can order different kinds of food because of food delivery aggregators. Customers are getting experimental. If they find the user experience to be good in any of the new age brands, there’s a consumption shift. The big QSRs have to innovate or offer a very different user experience,” said Karan Taurani, vice-president at Elara Capital. He added that margins for global brands have collapsed by 400-500bps (100 basis points = 1 percentage point) in the past few quarters because of discounting and promotions.

Any homegrown brand today can piggyback on Zomato and Swiggy to reach more customers and gain scale that offline stores alone may not suffice. Over the recent years, a plethora of new age brands like Good Flippin’ Burgers, La Pino’zPizza, Burger Singh, Wow! Chicken (by Wow! Momo) and Biggies Burger have swept the market. Brands like a Boba Bhai offer aloo tikki burgers at a starting price of Rs 59 and a chicken burger for Rs 149 while Burger Singh has a whole range of value burgers starting at Rs 39, prices lucrative enough to draw the school and college goers, a segment which players like McDonald’s and Burger King also target. Besides, premium restaurants have started delivering via the platforms, widening choice for consumers. “Apart from competition, companies like Zomato are bigger disruptors,”said Taurani.

The formalisation and continuous expansion of regional chains in QSR has impacted the growth story of these international brands, said Yadav. Regional players like a Nik Baker’s too are expanding and offering more food choices to consumers.