Avoid higher EMIs, interest rates! Planning to take a loan? Here’s how your credit score impacts loan rate, EMIs

[ad_1]

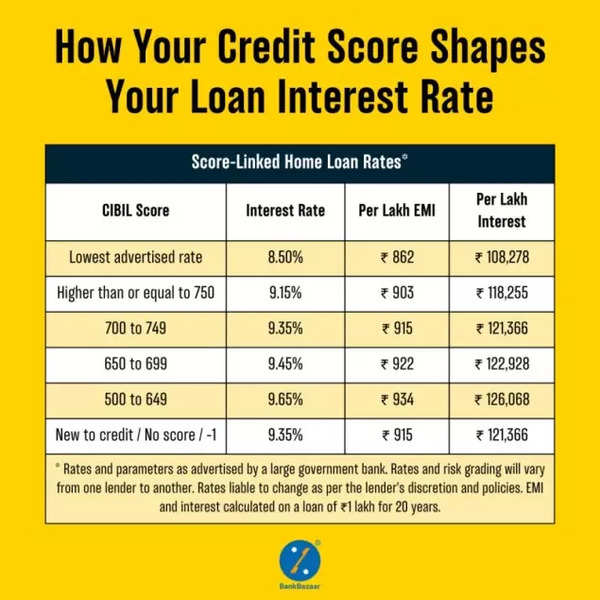

In a recent post on LinkedIn, Adhil Shetty explained the importance of maintaining a CIBIL (credit) score of 750 plus.Using a table detailing the EMI and interest rates offered corresponding to each CIBIL score as reference, the BankBazaar.com CEO described the inverse relation between credit scores and interest.

First-time loan-takers, Shetty warned, will have to pay interest rates similar to those with credit scores of 750 or below. The highest interest rate (9.65%), based on BankBazaar’s estimates, is charged from creditors whose scores fall in the 500-649 bracket.

The lowest advertised interest rate (8.50%), on the other hand, is charged from those with extremely high credit scores. The interest rate of 9.15% is charged from those with the comparatively attainable credit score of 750, or above.

How Your Credit Score Shapes Your Loan Interest Rate

Effectively, this means that borrowers with a 600 CIBIL score and a 750 CIBIL score will be paying an EMI of Rs 903 and Rs 934 (on a loan of Rs 1 lakh payable over 20 years), respectively. This illustrates the benefits of maintaining a high score.

“Your credit score impacts your loan interest rate. In a big-ticket loan such as a home loan, a sizeable interest difference due to a good score can help you save a ton of money. But with a very low score, you may not even get a loan from a bank—even at a high interest rate. Hence you should try to be above 750 at all time,” says Adhil Shetty.

The credit score is a numerical representation of an individual’s creditworthiness. The credit score ranges from 300 to 900, with higher scores indicating better creditworthiness. A score above 750 is generally considered good, making it easier for individuals to get loans and credit cards with favourable terms.

Also Check | Credit score tips: 7 ways to improve your CIBIL score

It is therefore important to be cognizant of the factors that influence one’s score, some of which are detailed below.

- Payment History: Outstanding balances, timely repayment, duration of credit-borrowing (calculated from opening date of oldest credit account), and credit card transactions are counted in the same.

- Credit Utilization: This refers to the ratio of the credit used to the total credit limit. Lower utilization indicates better credit management.

- Number of new accounts opened and closed – Opening a new account reduces the average age of your credit accounts, which can negatively impact your credit score.

- Credit Mix: A healthy mix of secured (like home loans) and unsecured (like credit cards) credit is likely to boost up your score.