Govt steps in to address finance concerns of exporters

[ad_1]

नई दिल्ली: commerce department has stepped in to work out a long-term solution to the credit woes of exporters, especially the smaller players, who are complaining of lack of access to finance with banks and RBI remaining mere spectator.

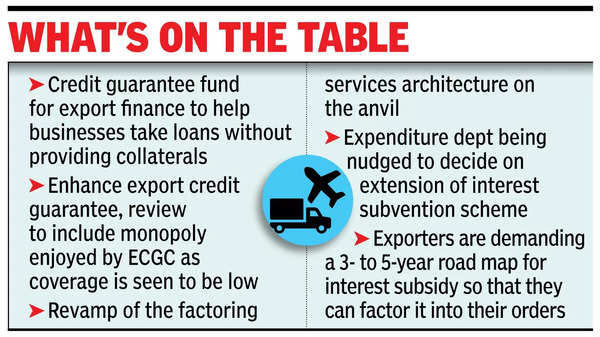

Among the options being discussed is a credit guarantee fund for export finance, modelled on the lines of the post-Covid loan package, that will free businesses from the requirement of providing collaterals.Problems with access to credit are in addition to the cost of credit, which has soared and is a major cause for concern at a time when freight rates have already surged in the wake of tension in West Asia, forcing ships to change their course and take a longer and more expensive route.

Data shared by exporters with commerce and industry minister Piyush Goyal showed that outstanding export credit has declined from around Rs 2.3 lakh crore at the end of March 2022 to under Rs 2.2 lakh crore last March, despite a 15% rise in exports in rupee terms during this period. Exporters are already complaining of the expenditure department’s reluctance to not just extend the interest subsidy scheme beyond Sept, but its failure to provide future guidance as it would help them price their products accordingly.

The constant credit-related complaints have prompted the directorate general of foreign trade (DGFT) to rope in consulting firm EY to assess a deep analysis as it considers multiple options.

The plan is to launch a multi-pronged assault on various issues related to financial services that exporters have to deal with. For instance, there is a growing view that the Export Credit Guarantee Corporation is unable to meet the entire requirements of business and trade. The coverage of the monopoly service provider is $80-90 billion when the coverage for merchandise exports needs to be of the order of $450 billion. “Why is it not expanding its footprint, may be, the time has come to review its monopoly,” a policymaker suggested.

Similarly, factoring remains at the periphery although the service should enable businesses to meet their cash requirements by allowing them to sell their account receivables to a third party at a discount.