Sent above a certain amount in outward foreign remittances? Here’s why you may be under I-T department scanner

[ad_1]

This action was taken after the discovery of cases where foreign remittances and expenditures were inconsistent with the income declared by individuals, as well as shortcomings in the collection of tax at source (TCS), sources familiar with the matter told ET.

The board has instructed its field formations to commence the verification process and scrutiny of Form 15CC, which is a quarterly disclosure statement of outward remittances submitted by authorized dealers to the income-tax department. The data from Form 15CC has been collected and segregated since 2016, and it will be available for analysis starting this year.

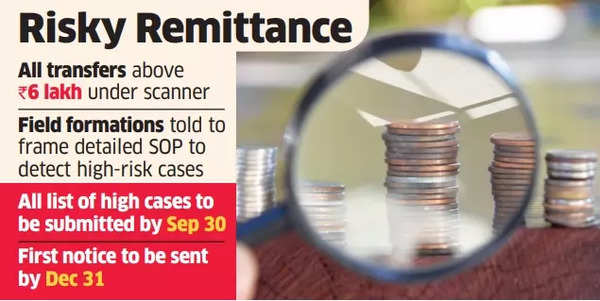

The board will create a list of high-risk cases based on the scrutiny of data from the 2020-21 financial year onwards. It has instructed the field formations to develop a detailed standard operating procedure (SOP) for detecting high-risk cases and to submit a list of such cases by September 30. The government has set a deadline of December 31 for sending initial notices to those identified as having undeclared income.

Risky remittance

“A comprehensive review was recommended last year… This will (soon) be made available to field formations for the first time,” a senior official told ET.

The initiative will enable the government to identify cases where remittances were sent but not reported by the taxpayer in their filings, the official added.

“The whole exercise will curb tax evasion and ensure that legitimate remittances are facilitated while preventing abuse of relaxations in foreign remittance reporting.”

An official has revealed irregularities in foreign remittances, citing a case where an individual with a declared annual income of Rs 5 lakh sent Rs 15 lakh abroad over the past three years, using multiple dealers to avoid mandatory Tax Collected at Source (TCS) and evade taxes.

Also Check | Latest FD rates: Which PSU banks are offering highest fixed deposit rates in August 2024? Check List

The government imposes a 20% TCS on foreign remittances exceeding Rs 7 lakh under the Liberalised Remittance Scheme (LRS), with certain exceptions for medical and education expenses. Form 15CC allows remitters to certify that their remittance is not taxable, exempting them from providing further details. This applies to payments by importers, companies to their subsidiaries, or loans to non-residents.

However, officials have identified potential misuse of this relaxation. “Monitoring these payments where exemption is claimed is crucial to prevent abuse of these relaxations,” said the official quoted above.

The CBDT has instructed banks to report total forex spends as a separate category, in addition to total credit card spends, even when not collecting TCS. This data is included in the annual income statement used for income tax assessment. The government increased TCS on foreign remittances under LRS from 5% to 20%, effective October 1, 2023.

The 2023 budget initially brought international credit card payments under the LRS and implemented TCS on such transactions. However, this decision was later reversed due to widespread criticism.