Increasing TDS/TCS entries irk taxpayers

[ad_1]

It’s something that the taxman loves but businesses and individuals often find cumbersome. With finance ministers routinely adding transactions requiring tax deduction at source (TDS) or tax collected at source (TCS), the number of entries requiring TDS or TCS is now close to the half century mark.

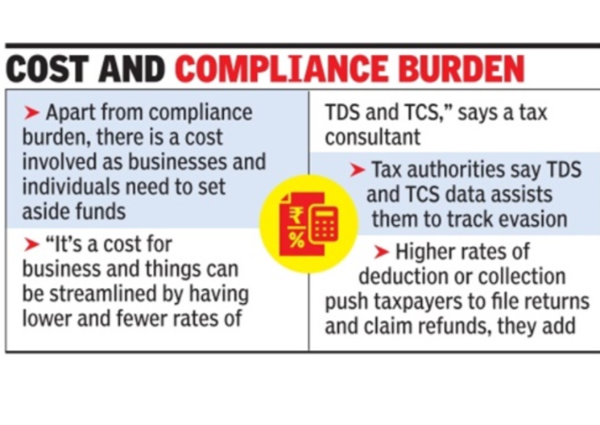

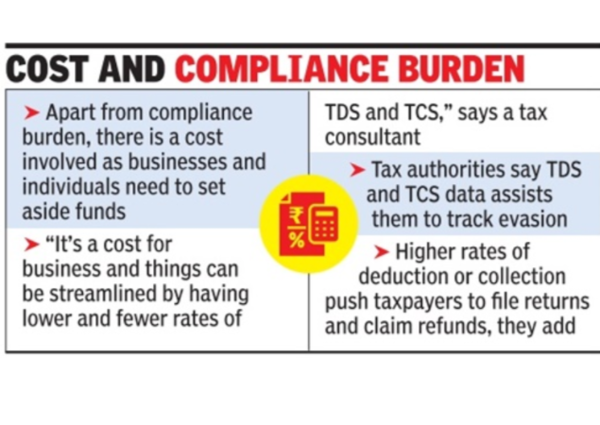

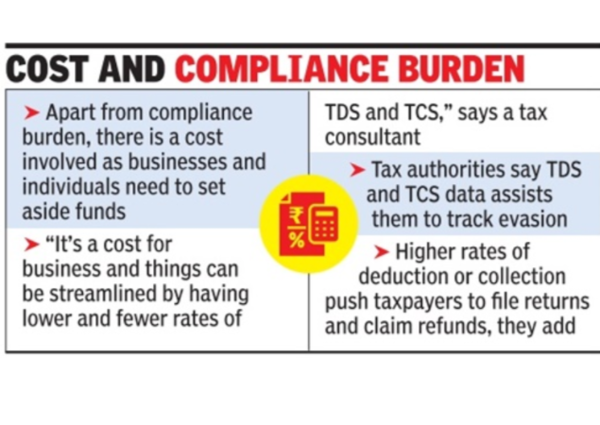

While there is a compliance burden — as it requires depositing the money after filling up a challan — there is also a cost involved as businesses and individuals have to set aside funds, often from the start of the financial year (if the transaction is in April) to the next financial year (till the department completes the assessment of returns).Often the rate can be as high as 20% as is the case with overseas tour packages and certain overseas remittances or even 30% for income from securitisation of trusts.

What complicates matters is the multiple rates — from 0.1% to 1%, 5%, 10% and so on. Besides, those with a PAN have a different rate from those who don’t.

Tax experts said in several cases, the TDS or TCS provisions were introduced at a time when data on several transactions was not available, which is now accessed by authorities due to Annual Information Returns and the Annual Information Statement requirements. Besi des, GST has helped the tax department access a large database, which is often tapped by authorities to nudge taxpayers to pay up.

“It is a cost for business and things can be streamlined by having lower rates and fewer rates of TDS and TCS,” a tax consultant with a leading firm said.

Tax authorities have a completely different take, arguing that TDS and TCS throw up data, which helps them track evasion. Besides, they argued that higher rates of deduction or collection, actually encourage taxpayers to file returns and claim refunds. “We have seen in the past that several car buyers would go for TCS but did not file returns. If the rate is high, it automatically forces them to file returns, helping the department get revenue,” a senior officer said.

While there is a compliance burden — as it requires depositing the money after filling up a challan — there is also a cost involved as businesses and individuals have to set aside funds, often from the start of the financial year (if the transaction is in April) to the next financial year (till the department completes the assessment of returns).Often the rate can be as high as 20% as is the case with overseas tour packages and certain overseas remittances or even 30% for income from securitisation of trusts.

What complicates matters is the multiple rates — from 0.1% to 1%, 5%, 10% and so on. Besides, those with a PAN have a different rate from those who don’t.

Tax experts said in several cases, the TDS or TCS provisions were introduced at a time when data on several transactions was not available, which is now accessed by authorities due to Annual Information Returns and the Annual Information Statement requirements. Besi des, GST has helped the tax department access a large database, which is often tapped by authorities to nudge taxpayers to pay up.

“It is a cost for business and things can be streamlined by having lower rates and fewer rates of TDS and TCS,” a tax consultant with a leading firm said.

Tax authorities have a completely different take, arguing that TDS and TCS throw up data, which helps them track evasion. Besides, they argued that higher rates of deduction or collection, actually encourage taxpayers to file returns and claim refunds. “We have seen in the past that several car buyers would go for TCS but did not file returns. If the rate is high, it automatically forces them to file returns, helping the department get revenue,” a senior officer said.

Cost and compliance burden

In 2017, when PM Narendra Modi addressed tax officers, he had not only set a target of having 10 crore assesses — there are around 8 crore direct tax returns — but also suggested that there was a need to collect more revenue from scrutiny of returns, which at that time generated 8%.