More pain in store as FMCG prices inch up

[ad_1]

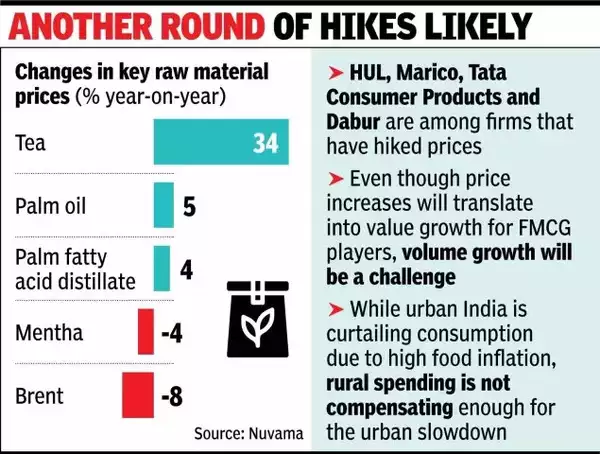

MUMBAI: Middle-class household budgets are likely to come under pressure as FMCG companies resort to price hikes to pass on commodity inflation. This comes just after Diwali when consumers often splurge on festive purchases, placing a strain on their wallets. Several fast-moving consumer goods companies have indicated that more price hikes may be in store.

HUL, Marico, Tata Consumer Products and Dabur are among firms that have hiked prices. “Erratic weather patterns have affected tea and salt production leading to input cost inflation…. staggered price increases have been actioned and you will see more price increases around the corner,” Tata Consumer Products MD & CEO Sunil D’Souza said in a recent earnings call, adding that consumer demand is under stress.

While price increases will translate into value growth for FMCG players, volume growth will be a challenge. In fact, companies are feeling the pinch on the ground. While urban India is curtailing consumption due to high food inflation, rural spending is not compensating enough for the urban slowdown. “Since June, urban growth has moderated. While rural growth has become accretive to total growth, its pace of recovery has been gradual,” said HUL MD & CEO Rohit Jawa. Stock price of all FMCG companies ended in the red on the BSE on Monday amid a broader bearish market ahead of the US presidential election.

Within urban, the lower middle class segment has been impacted though govt schemes have partly helped in insulating bottom-of-the-pyramid segments from the impact of food inflation, said Saugata Gupta, MD & CEO at Marico, which has taken price increase in the coconut oil portfolio. “We will take calibrated pricing actions in response to the rising trend in input costs. Food and retail inflation trends will be the key parameters to be tracked in the coming quarters,” Gupta said, projecting a pick up in pricing growth in the second half of FY25.

ITC saw inflationary headwinds across commodities including edible oil, wheat, maida and potato in Q2. The high prices of palm oil were further “exacerbated” by import duty hike in oil, said Sudhir Sitapati, MD & CEO at Godrej Consumer Products, describing palm oil as the “problem” this year. “We will recover the margin through judicious price increases and stabilising our costs over the next few quarters,” Sitapati said.

Dabur India CEO Mohit Malhotra said that food inflation is “worrying” and it has shifted money from discretionary spends to essentials. The company which has hiked prices by 1.3% in Q2, however, said that urban consumption slump has bottomed out and should see improvement.

Expectations of a good crop output and moderation in inflation, improving agriculture terms of trade and govt’s thrust on public infrastructure and rural sector should support broader consumption going ahead, ITC said.