Sensex slides nearly 700 points on global cues, profit-taking

[ad_1]

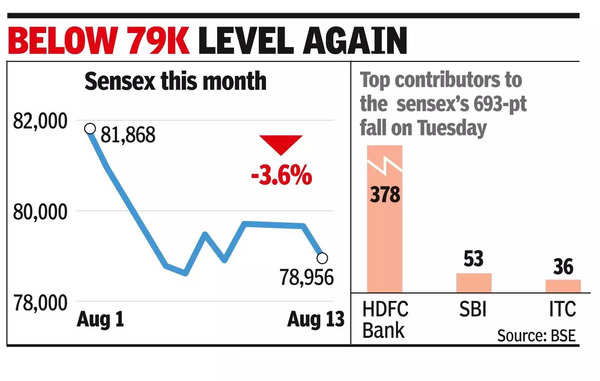

As a result, the sensex lost nearly 700 points or 0.9% to close at 78,956 points while on the NSE, Nifty closed 208 points or 0.9% down at 24,139.

Foreign funds continued to sell aggressively on Tuesday and recorded a net selling figure of Rs 2,107 crore while domestic funds were net buyers at 1,240 crore, BSE data showed. The day’s sell-off also left investors poorer by nearly Rs 4.3 lakh crore with BSE’s market capitalisation now at almost Rs 458 lakh crore.

According to Prashanth Tapse of Mehta Equities, the domestic indices underperformed global equity markets as investors resorted to profit-taking in banking, IT, telecom, metals, and oil & gas shares. “Despite falling inflation levels, economists were of the view that inflation will rise once again, which could mean that RBI will not be in a hurry to tinker with interest rates in the near term. Also, current market valuations are very high and hence we may witness select profit booking with bouts of intra-day volatility in the near term.”

In Tuesday’s session HDFC Bank fell 3.5% after MSCI said the private sector lender’s weight in a global index would go up to 7.5% but the increase would be in two tranches, less than what the market had anticipated. This led to some selling in HDFC Bank stock, market players said.

Strong listings:

Despite the weakness in the broader market, Tuesday witnessed two blockbuster listings, those of Brainbee Solutions (FirstCry) and Unicommerce eSolutions. The stock price of FirstCry, which last week closed its IPO of nearly Rs 4,200 crore, listed at Rs 625, up about 40% from its offer price of Rs 465. On the BSE, it closed at Rs 678, up almost 46%. It now has a market cap of Rs 35,214 crore. Unicommerce eSolutions more than doubled on listing.