‘Swiggy quick-commerce may beat food delivery business’

[ad_1]

MUMBAI: Quick commerce has the potential to become bigger than the food delivery business because of the larger market opportunity the segment can tap into, Sriharsha Majety, co-founder and group CEO at Swiggy, said. The startup is set to launch its Rs 11,327 (about $1.4 billion) IPO – the second largest public issue to hit the market this year after Hyundai Motor India’s Rs 27,870 crore offer and the sixth-largest so far – on Nov 6.

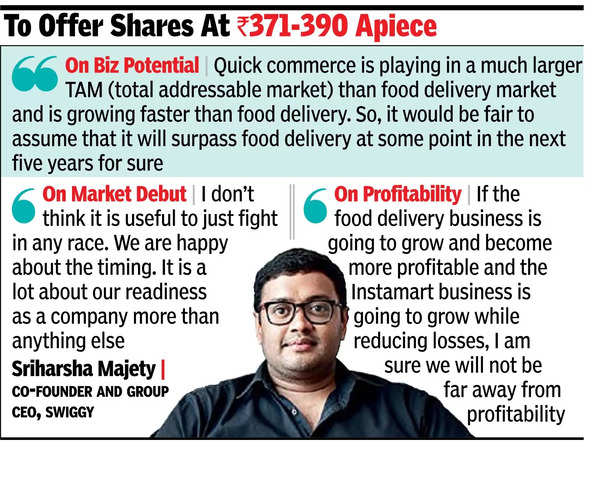

“Quick commerce is playing in a much larger TAM (total addressable market) than food delivery market and is growing faster. So, it would be fair to assume that it will surpass food delivery at some point in the next five years for sure,” Majety told TOI in an interview.

Founded in 2014, Swiggy is going public three years after arch-rival Zomato‘s Rs 9,375 crore IPO hit Dalal Street. Majety, who maintains a low profile unlike several other billion-dollar startup founders, said that as a company, Swiggy wanted to go public when it was “ready” to tackle the responsibilities a market debut brings forth and that not everything is about “who is going (public) first”. “I don’t think it is useful to just fight in any race. We are happy about the timing. It is a lot about our readiness as a company more than anything else,” he said.

The bidding for Swiggy’s IPO will start on Nov 6 and end on Nov 8 at a price band of Rs 371-390 per share. At the upper end of the price band, the implied valuation of the firm is $11.3 billion, lower than the valuation of about $13 billion it was targeting earlier. “Pricing is the factor of a lot of things… what the investors have thought about it, what our overall performance trajectory is. Macro does play a role, we can’t deny the fact that there is a certain softness that happened recently,” CFO Rahul Bothra said. However, the IPO valuation it’s eyeing is higher than the $10.7 billion at which the company had raised $700 million from investors in Jan 2022.

Of the total funds being mobilised through the offer, Swiggy is raising Rs 4,499 crore through a fresh issue of shares, while the balance Rs 6,828 crore will be an offer for sale by existing shareholders including its biggest investor Prosus and others like Accel and Elevation Capital. The shareholding of Prosus will fall below 25% after the listing.

Majety said that the company’s food delivery business is already profitable and losses for the Instamart business are narrowing without setting any target on achieving net profitability. “If the food delivery business is going to grow and become more profitable and the Instamart business is going to grow while reducing losses, I am sure we will not be far away from profitability,” he added.